The global energy landscape is set to witness a historic turning point following the capture of Nicolas Maduro by the US forces on January 3 and US President Donald Trump’s announcement to “take back” Venezuela’s oil reserves.

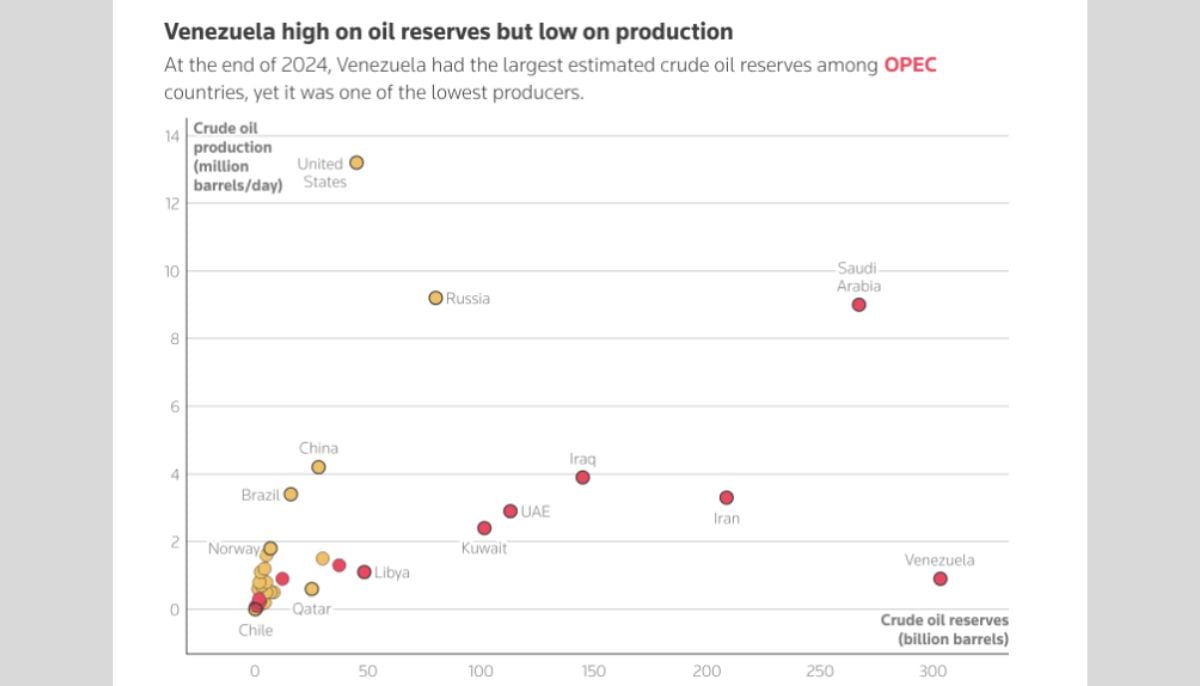

According to the London-based Energy Institute, Venezuela sits atop the world’s largest proven reserves, holding 17 percent of global reserves, even ahead of the Organization of the Petroleum Exporting Countries (OPEC).

Here are the details of Venezuela oil reserves and why they matter to the United States.

Statistical overview of Venezuela’s oil reserves and output

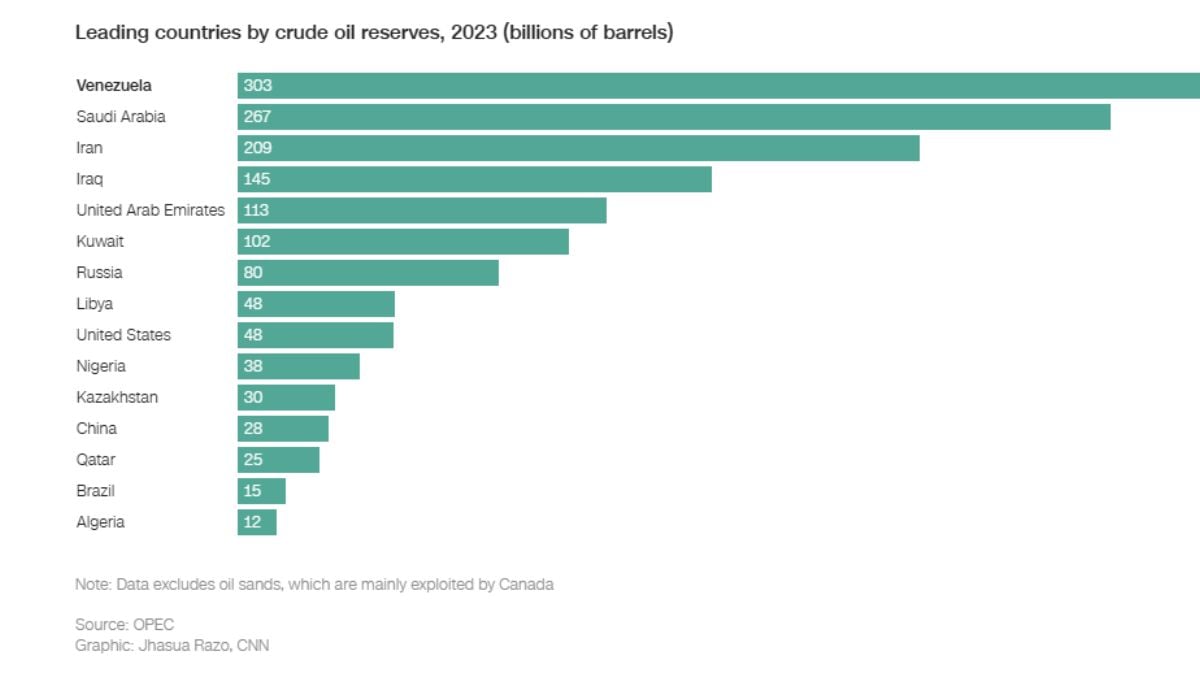

The South American country holds the world’s largest known oil reserves which are estimated to be some 303 billion barrels.

Despite being a founding member of OPEC with Iraq, Iran, Kuwait and Saudi Arabia, Venezuela falls short in global output.

- In the 1970, the country produced 3.5 million barrels per day, representing 7 percent of global oil output.

- During the 2010s, the production dropped below 2 million bpd.

- In November 2025, the output plunged to 860,000 bpd, amounting to 1 percent of global production.

The stark gap between Venezuela’s reserves and output is driven by the various factors, including US sanctions, underinvestment, pervasive corruption, dilapidated oil infrastructure, and mismanagement.

Venezuela oil potential and US interests

According to the US government’s energy department, Venezuela’s oil reserves mostly consist of heavy oil, rich with high sulfur content. Producing this type of oil requires specialized equipment and technical expertise that the country lacks.

Here’s the interests of the US. US’ oil is good for making gasoline and nothing else. On the other hand, Venezuelan “heavy, sour” crude is essential for producing diesel, asphalt, and industrial fuels.

Given the constrained supply of diesel globally, the US can take dominance over diesel supply.

Moreover, Tapping into Venezuela’s oil industry would be financially beneficial for the US.

According to Phil Flynn, senior market analyst at the Price Futures Group, “Most US refineries were constructed to process Venezuela’s heavy oil, and they’re significantly more efficient when they’re using Venezuelan oil compared to American oil.”

Which US companies could be involved?

After Maduro’s detention, Trump announced plans to run Venezuela and signalled a new era of American involvement, vowing the US’ biggest oil companies will spend billions of dollars, fix the badly broken oil infrastructure, and start making money for the country.

The companies in line include Exxon Mobil and ConocoPhillips. Both oil giants were functional in Venezuela but left after their assets were nationalised under Hugo Chavez. Another major US oil company is running the operations in Venezuela.

Given Trump’s statement, these companies have not yet commented on any potential investment.

Jorge León, the head of geopolitical analysis at Rystad Energy, an industry consultancy, said “My hunch is that if President Trump said this publicly, probably there was already an agreement with the US companies.”

US strategic intervention & future of China’s exports

When it comes to Venezuela’s oil customers, China comes first. Around 80 percent of oil is exported to China through supertankers.

According to market observers reported by The Guardian, the US’ control over the Venezuelan oil industry could give it leverage on two fronts.

First, it would fulfill Trump’s mission to establish the US as a world-leading energy superpower by exporting more crude oil.

Second, the US would influence prices at which China is receiving the shipments, putting them closer to market rate and jeopardizing China’s efforts to secure energy at discounted amounts.

Implications for global oil markets amid turmoil

According to experts from the research firm Third Bridge Energy, the events driven by political turmoil will probably not change oil or gas prices right away. However, based on traders’ and investors’ reactions things could change.

On Monday, oil prices fell slightly. Brent crude dropped by 23 cents to $60.52 and US oil declined by 21 cents to $57.11 per barrel.